In a sign that interests in the store network area stay solid, Pando, a startup creating satisfaction the executives innovations, today declared that it has brought $30 million up in a Series B round, carrying its complete to $45 million.

Iron Point of support and Uncorrelated Endeavors drove the round, with existing financial backers Nexus Adventure Accomplices, Chiratae Adventures and Next47 likewise taking an interest. Chief and organizer Nitin Jayakrishnan says the new capital will go towards extending Pando's worldwide deals, showcasing and conveyance capacities.

"We won't venture into new enterprises or neighboring item regions," he told TechCrunch in an email interview. "Incredible ability is the underpinning of the business - we will keep on enlarging our groups at all levels of the association. Pando is likewise open to investigating key organizations and acquisitions with this round of financing."

Pando was mutually sent off by Jayakrishnan and Abhijeet Manohar, who recently cooperated on iDelivery, a delivery innovation commercial center in India - and their initially startup. The two saw direct that makers, merchants and retailers were battling with obsolete innovation and guide arrangements toward comprehend, improve and deal with their worldwide coordinated factors activities - or if nothing else that is the story Jayakrishnan tells.

"Production network pioneers were attempting to construct their own innovation and toss individuals at the issue," he said. "This grabbed our eye us He went through months conversing with stockroom and construct venture clients for them, Manufacturing plants, transporting yards, ports, and eventually, in 2018, I chose to begin Pando to make worldwide operations arrangements by offering a product as-a-administration stage."

There is truth in Jayakrishnan's demeanor of repressed request. As indicated by a new McKinsey review, production network organizations had — and have — a powerful urge for instruments that give more prominent inventory network perceivability. 67% of overview respondents said they have carried out dashboards for this reason, while the greater part said they are putting resources into production network perceivability benefits all the more comprehensively.

Pando means to address an issue by coordinating store network information that dwells in various storehouses inside and outside the association, remembering information for clients, providers, strategies suppliers, offices, and item SKUs. The stage gives different apparatuses and applications to achieve different errands across cargo acquirement, exchange and transportation the executives, cargo inspecting, installments and report the board, as well as dispatch arranging and investigation.

Clients can redo instruments and applications or make their own utilizing Pando APIs. This, alongside the stage's emphasis on no-code capacities, separates Pando from officeholders like SAP, Prophet, Blue There, and E2Open, Jayakrishnan declares.

"Pando comes pre-coordinated with driving ERP frameworks and has prepared APIs and an expert administrations group to incorporate with any new ERP and venture frameworks," he added. "Pando's sans code abilities permit business clients to redo applications while keeping up with stage respectability - diminishing the requirement for IT assets for every customization."

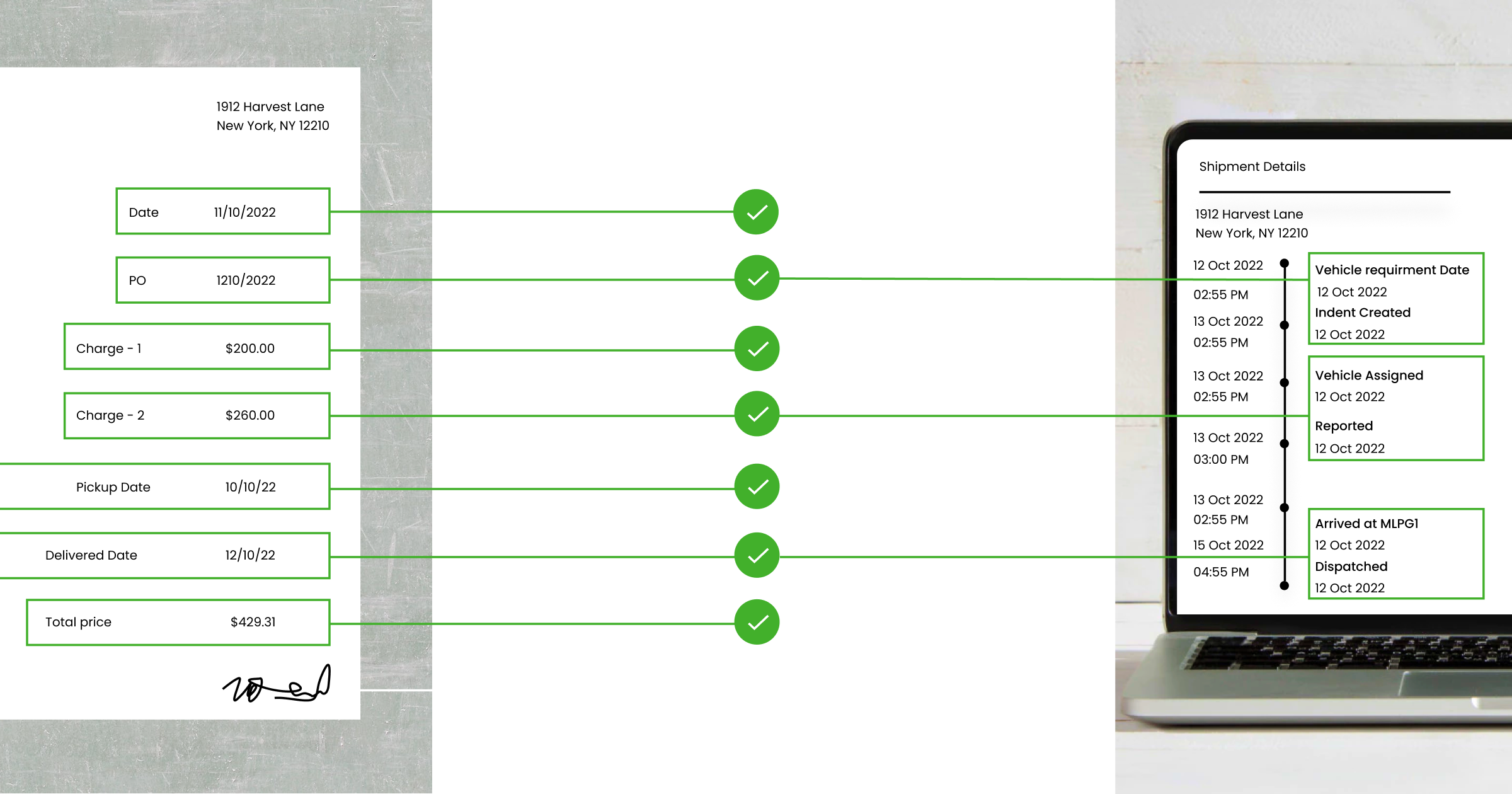

Pando is doing its best to automate the processes around the supply chain. Image credits: Bando

Pando also uses algorithms and forms of machine learning to make predictions about supply chain events. For example, the platform attempts to match customer orders with suppliers and customers through the “right” channel (in terms of aspects such as cost and carbon emissions) and execution strategy (such as shipping method, carrier, etc.). Moreover, Pando can detect anomalies between deliveries, orders, and freight bills and predict supply chain risks given supply and demand trends.

Pando isn’t the only seller doing this. Altana, which secured $100 million in venture capital last October, uses an AI system to connect to and learn from logistics and business data — creating a shared view of supply chain networks. Everstream, another Pando competitor, offers its own data analytics dashboards, integrated with existing enterprise resource planning (ERP), transportation management, and supplier relationship management systems.

But Pando has a compelling sales proposition, judging by its momentum. The company counts Fortune 500 manufacturers and retailers–including P&G, J&J, Valvoline, Castrol, Cummins, Siemens, Danaher, and Accuride–among its customer base. Jayakrishnan said that since the startup’s first series in 2020, revenue has grown 8-fold while the number of customers has increased 5-fold.

When asked if he expects expansion to continue in the future, given signs of potential trouble on the horizon, Jayakrishnan sounded rather optimistic. He pointed to a Deloitte survey that found more than 70% of manufacturing companies were affected by supply chain disruptions in the past year, with 90% of those companies experiencing increased costs and decreased productivity.

The result of such great disturbances? It’s estimated that the digital logistics market will grow to $46.5 billion by 2025, per market and by market — compared to $17.4 billion in 2019. Crunchbase reports that investors injected more than $7 billion in seed through growth-stage rounds on The global share of supply chain-focused startups from January to October 2022, nearly surpassing the record highs of 2021.

“Pandu has a strong balance sheet and profit and loss statement, with a focus on earnings growth,” Jayakrishnan said. “We are expanding our operations in North America, Europe and India with notable customer wins and a strong network of partners… Pando is well positioned to ride this wave of growth, driving supply chain resilience for Economy 2030.”

.jpg)